Property appraisals reach a record high in Marion County

Property Appraiser Jimmy Cowan reports a record appraisal and tax revenue figure, produced by increased market values and high sales volume, with sticker shock for some home buyers.

belea@magnoliamediaco.com

In the 31 years that Marion County Property Appraiser Jimmy Cowan has worked in the office, he’s seen it all, both booms and busts in the local real estate market. Then came 2023, which produced record-breaking property tax assessments and market value increases.

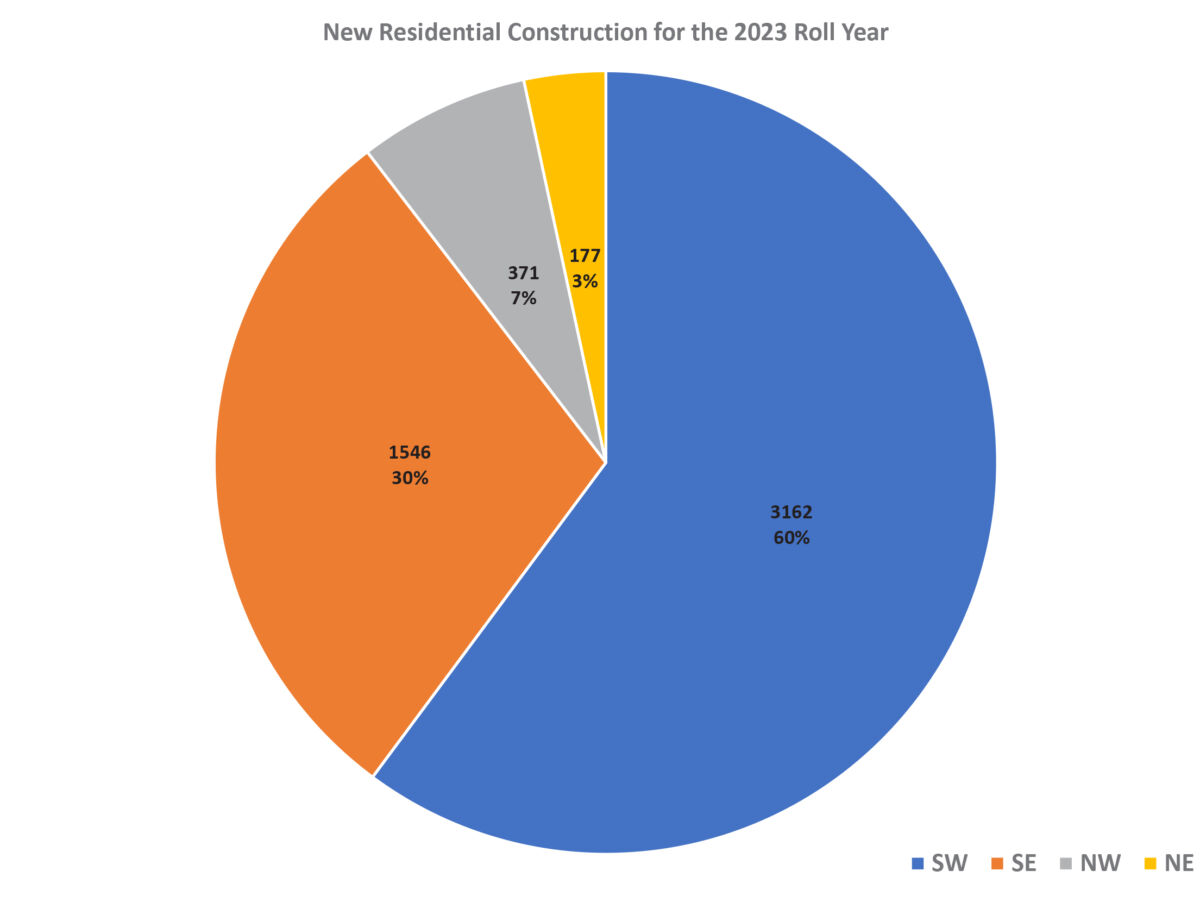

“From 2020-2023, we’ve added over 15,000 new homes to the assessment roll in the county,” Cowan said. The total new construction value that was added to the assessment roll in 2023 was nearly $1.7 billion, a record for Marion County.

The record revenue figure is partly produced by inflation-created increased market values for homes and new home sales at higher values that generate much more tax revenue, even if the millage rate remains the same.

For example, in a specific subdivision in On Top of the World the median sales price for a 1,500-square-foot home has soared from $185,000 in 2020 to $292,000 in 2023, an increase of over 63%. The increase in sales price means the market values and assessed values have increased as well for non-homestead properties.

For 2023, real property taxes generated over $606 million in total taxes levied. For 2022, that figure was $522 million and in 2021, that figure was $464 million.

Marion County growth means increased sales and market values

The enormous influx of new residents in Marion County has impacted the volume of home sales and generated new requests for homestead exemptions. As people move into the county, some purchase homes and become eligible for the homestead exemptions that help to reduce a homeowner’s tax assessment.

Cowan reported that deed transfers over the last three years have increased substantially, which includes both existing homes and new builds. In 2020, the total number of deed transfers was 37,222; in 2021, that figure increased to 46,641; and in 2022, that figure was 49,269. Final figures aren’t yet available for 2023, but Cowan estimated that about 41,000 deed transfers took place last year, all of which generate work for the property appraiser office and staff. The dropoff may be due, in part, to rising interest rates.

“We look at what’s recorded in the Clerk of Court’s office whether it be for sale by owner, MLS, whatever the case may be,” Cowan said. “Anything that’s recorded in the Clerk’s office is worked up for appraisal. We try to interview both the seller and the buyer to ensure it’s an arms-length transaction. There’s no undue stimuli, no foreclosure, no short sales, no personal property involved to make sure it’s a qualified sale. Anything from family member to family member, anything that wouldn’t be out on the market for everybody else to see would be unqualified.”

Cowan reminds people that his office doesn’t set prices or tax rates.

“We are solely responsible for values and exemptions,’’ he said. “We have no clue what the tax rates are going to be and have nothing to do with that. We look strictly at what are the values based on previous years’ sales.”

Marion County appraisal values are based on median numbers, which reflects a more even-handed approach to appraisals as it omits low and high sales that might skew the general values for the county. “We use the median value of the sales, which throws out the really low and really high figures,” Cowan said.

Avoiding sticker shock for home purchases

The homestead exemption allows for a decrease in the taxable value of a home by allowing various exemptions, which decreases an owner’s tax liability.

The Save Our Homes Act took effect for 1995 tax roll, and Cowan said, “It limited the amount of increase that could be put on a homestead property in a year’s time, and that limitation was 3%, or the Consumer Price Index, whichever was lower. The last two years we have been at 3% even though the cost of living is way higher than 3%.”

From 2009-2021, many previous years’ assessments were lower than 3% when inflation was less prevalent. For example, the value cap in 2021 was 1.4% and was down to .70% in 2016 and .80% in 2015.

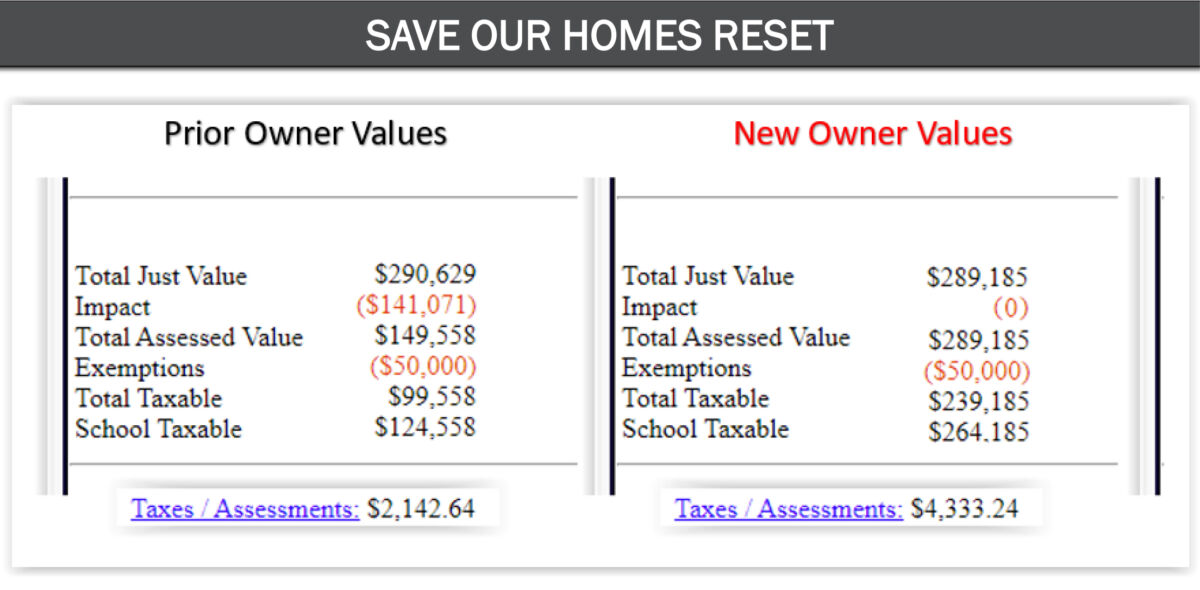

The “sticker shock” occurs when new buyers’ properties are assessed at market value after the sale.

“What ends up happening is … say I buy a property that you’ve been living in for the last three years, (the buyer) usually gets the benefit of (seller’s) homestead for the current year of taxation,” he said.

But often real estate agents, title insurance staff and others may base their calculations using the benefit of the previous owner’s exemptions and previous years’ rates and values. “This is what your taxes will be based on the seller’s exemptions and Save Our Homes benefits,’’ he said.

But that doesn’t take into account the new assessed market value and the loss of the previous owner’s exemptions.

“What happens is, when they file the first year on their own, especially if they’re an out-of-state buyer, a first-time buyer or haven’t had homestead in the last three years, the reset comes into play,’’ Cowan explained. “The market value and the assessed value become the same number and that Save Our Homes (homestead exemption) from the previous owner goes away, and that’s where the shock and awe comes in.”

“I’ve seen tax bills go from $2,000 to $7,000 or $8,000,’’ he said. “In the past two years, we’ve had people literally crying to us because the escrow goes up so much, saying, ‘I can’t afford this.’”

Cowan advises people to research their tax situation before closing on a home. The Property Appraiser’s office will help do an estimate for buyers. Buyers can call the office, use the online calculator or use the app available from Apple and Google Play.

Cowan said he would rather have buyers ask first before they get into a financial situation that might become a hardship.

“I would hope that people doing their due diligence would come and ask us, not someone who’s trying to sell them something. Please call us. We’re glad to help” develop a tax estimate,’’ he said. It’s in a buyer’s best interest to look at both first- and second-year tax estimates.

Real estate broker Sean Maher owns and operates Florida Real Estate Lifestyles, and has seen varied responses from buyers he deals with; some care a lot about taxes and some don’t. Still, he tries to educate his clients and prepare them future assessments.

“If the seller purchased it for $80,000,” Maher said, “and you bought it for $260,000, well, the taxes are going to go up. I send my buyers a reminder letter that they may be entitled to a reduction (in taxes). I send buyers directly to the county. Exemptions may be available to you, and you don’t want to share the details of your life with me, which is fine.”

The county can offer information about widow/widower exemptions, exemptions for blindness or other disabilities and other statuses that a buyer may not feel comfortable with a real estate agent knowing. “The county can do that estimate for them,” and offer more accurate information than an agent could.

“If they’re coming from New York, whatever they see is cheap to them!” Maher said with a laugh. And the comparatively lower taxes in Marion County don’t faze them.

There is proposed legislation that will require tax estimators be made available through the MLS, Zillow, Realtor.com and the like. Cowan would like the see those in place to help buyers get more accurate information about their transactions.

Market values always changing

Cowan sees property values staying consistent or increasing as Marion County continues to grow. He doesn’t anticipate a housing market meltdown as happened during the 2008-2010 Great Recession “because mortgage lending has tightened up to the point where people can actually afford the homes they have. Plus, more people (in Marion County) are paying cash for their homes. There may not be as many mortgages as there were in ‘07-‘08. Even recently, people are bidding stuff up and still paying cash, coming from California, up north, and values went up.”

Cash buyers who don’t need to qualify for a mortgage can pay whatever price they’re comfortable with, and this seller’s market helps to skew county values to higher rather than lower.

Also influencing overall market values are the new builds.

“We eclipsed our record for new (home) construction. Last year, (2023) was over $1.66 billion for Marion County as a whole,” Cowan said. The majority of that new construction is in the southwest part of the county.

Appraisal variability

Cowan’s office uses a CAMA (computer-assisted mass appraisal) system to help with the volume of work required to manage the county’s appraisals. The system was written in-house by appraisal staff and went live in 2009. Cowan’s team now has nearly 300,000 parcels to track.

In 2015, the office tracked about 287,000 parcels; in 2023 that figure rose to 299,953. This is partly due to larger tracts of land being sold off and divided into new developments.

Appraisal value is affected by various elements of the property. Interestingly, the number of bedrooms doesn’t affect a home’s value as much as total square footage. The size of the garage does affect value—a four-car garage will assess for more than a two-car–and pools make a difference, too.

Cowan said, “Basically, anything permanently affixed on a real estate parcel is generally assessed.” So a simple backyard shed on blocks used to store a lawnmower wouldn’t be assessed if not permanently affixed, but a fixed, detached utility shed with water and electricity would be.

Cowan’s office handled about 41,000 deed transfers in 2023 and about 12,800 homestead exemptions applications. And again, the number of homestead exemption applications has increased. For 2020, the figure was 10,950; in 2021 it was 10,299; and for 2022 those applications increased to 12,300.

Most of the exemption requests can now be done online so that helps with the number of personal requests the staff has to handle in person. The only exemption process that can’t be done online currently is an agricultural classification.

Property Tax Estimator

pa.marion.fl.us/TaxPortabilityEstimator.aspx

From the Marion County Property Appraiser website or app, use the dropdown menu for online services and choose property tax estimator. To estimate taxes on a home sale, pull the required information from the property record card or TRIM tax notice. The tax district is based on the geographic area of the county. Just value means the market value on noted on the property record card. Note too that non ad valorem taxes are NOT included. Additional taxes for fire, waste and stormwater will add to the total tax bill.

This is the Disclosure Law in the Florida Statutes on disclosure of ad valorem taxes to a prospective purchaser.

Florida Statute 689.261 Sale of residential property; disclosure of ad valorem taxes to prospective purchaser.

(1) A prospective purchaser of residential property must be presented a disclosure summary at or before execution of the contract for sale. Unless a substantially similar disclosure summary is included in the contract for sale, a separate disclosure summary must be attached to the contract for sale. The disclosure summary, whether separate or included in the contract, must be in a form substantially similar to

the following:

PROPERTY TAX

DISCLOSURE SUMMARY

BUYER SHOULD NOT RELY ON THE SELLER’S CURRENT PROPERTY TAXES AS THE AMOUNT OF PROPERTY TAXES THAT THE BUYER MAY BE OBLIGATED TO PAY IN THE YEAR SUBSEQUENT TO PURCHASE. A CHANGE OF OWNERSHIP OR PROPERTY IMPROVEMENTS TRIGGERS REASSESSMENTS OF THE PROPERTY THAT COULD RESULT IN HIGHER PROPERTY TAXES. IF YOU HAVE ANY QUESTIONS CONCERNING VALUATION, CONTACT THE COUNTY PROPERTY APPRAISER’S OFFICE FOR INFORMATION.

(2) Unless included in the contract, the disclosure summary must be provided by the seller. If the disclosure summary is not included in the contract for sale, the contract for sale must refer to and incorporate by reference the disclosure summary and include, in prominent language, a statement that the potential purchaser should not execute the contract until he or she has read the disclosure summary required by this section.

Featured Local Savings

Support community journalism

The first goal of the Ocala Gazette is to deliver trustworthy local journalism so corruption, misinformation and abuse are not hidden from the public or unchallenged.