Penny sales tax boosts projects across city

US coins collection isolated on white, obverse and reverse

Defund the Police became a slogan during the summer of 2020 after the death of George Floyd at the hands of police officers in Minneapolis. Since then, politicians and candidates have used the phrase to decry any shift in funding for public safety.

In the runup to the Sept. 21 Ocala elections, some local candidates have commented on shifts to planned allocations of penny sales tax revenue away from the city’s public safety departments in the context of defunding emergency services.

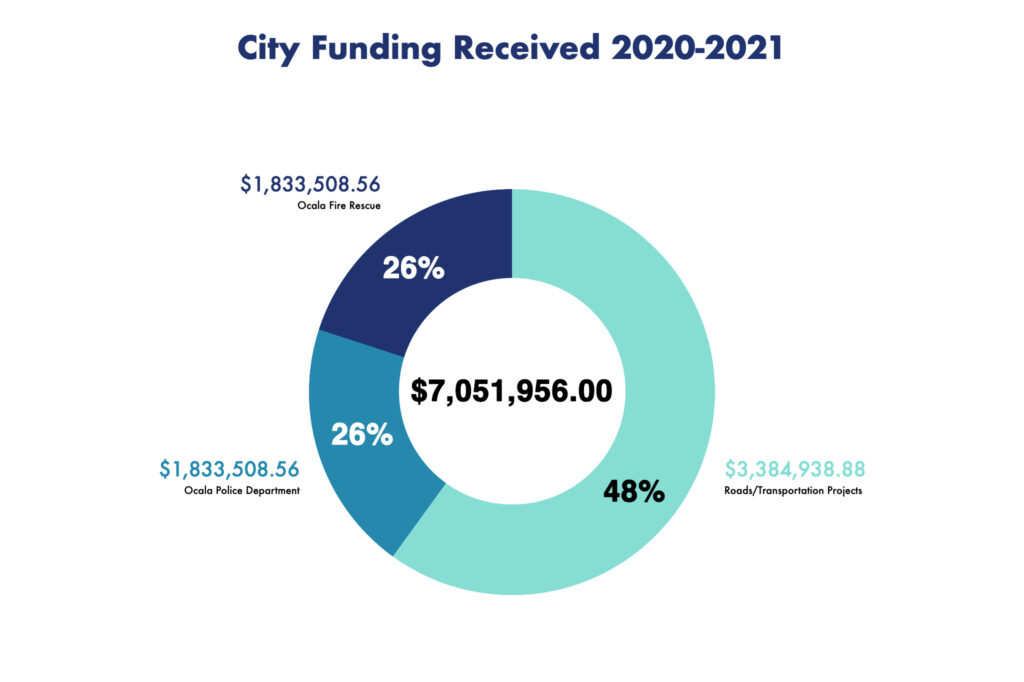

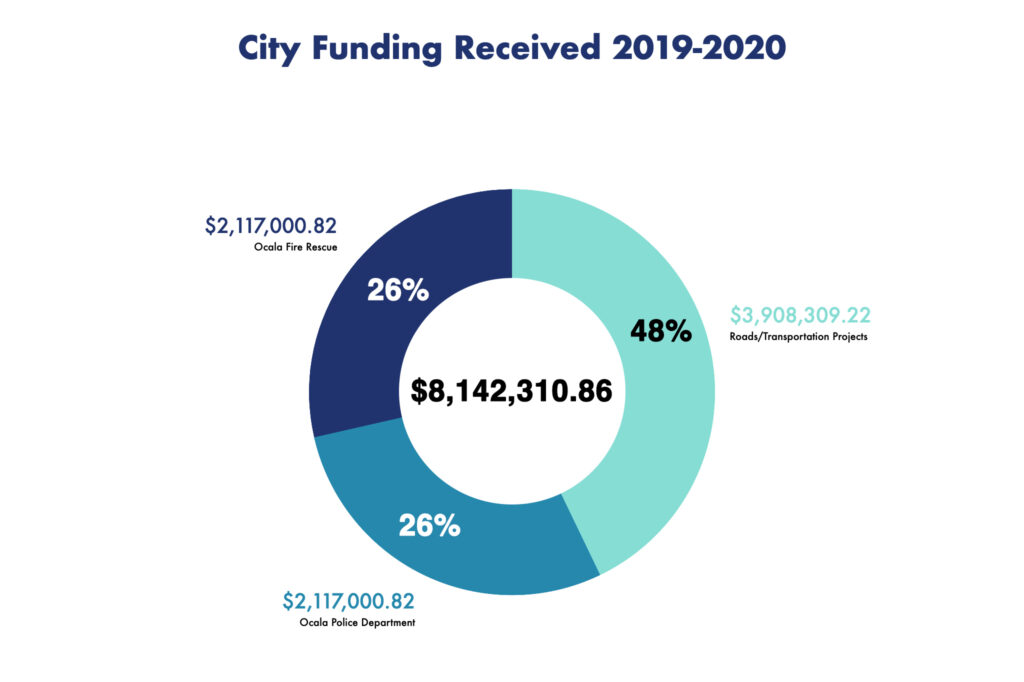

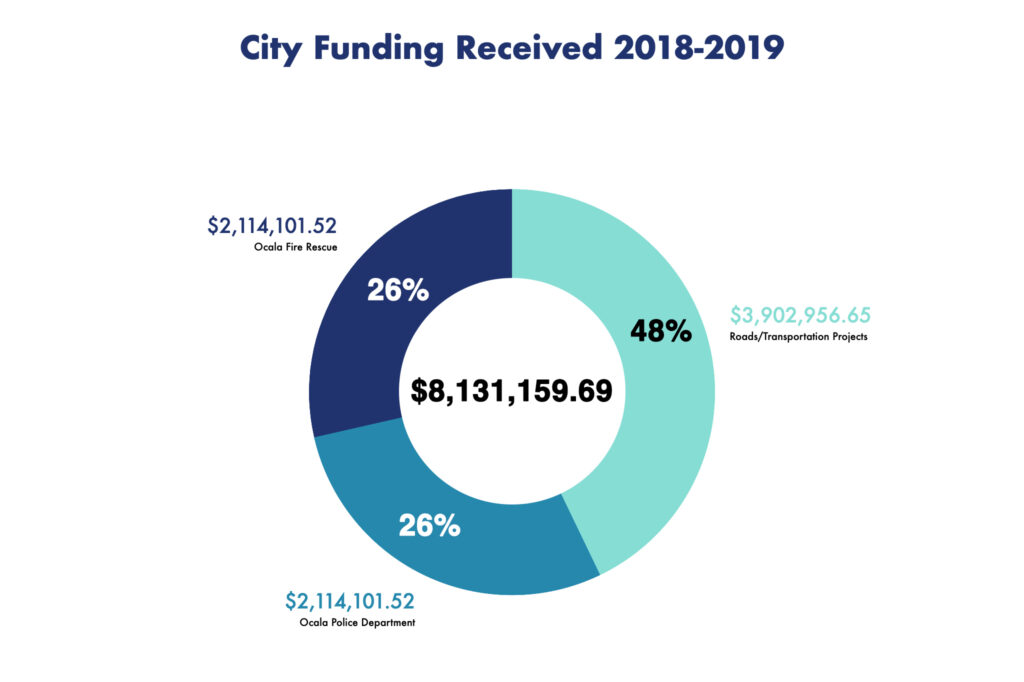

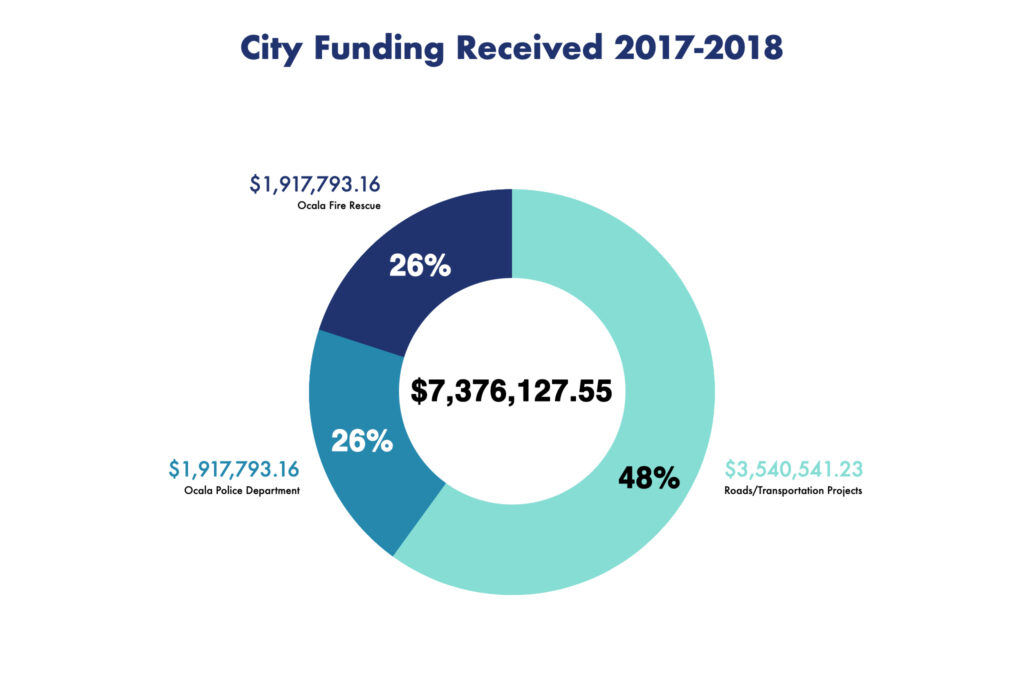

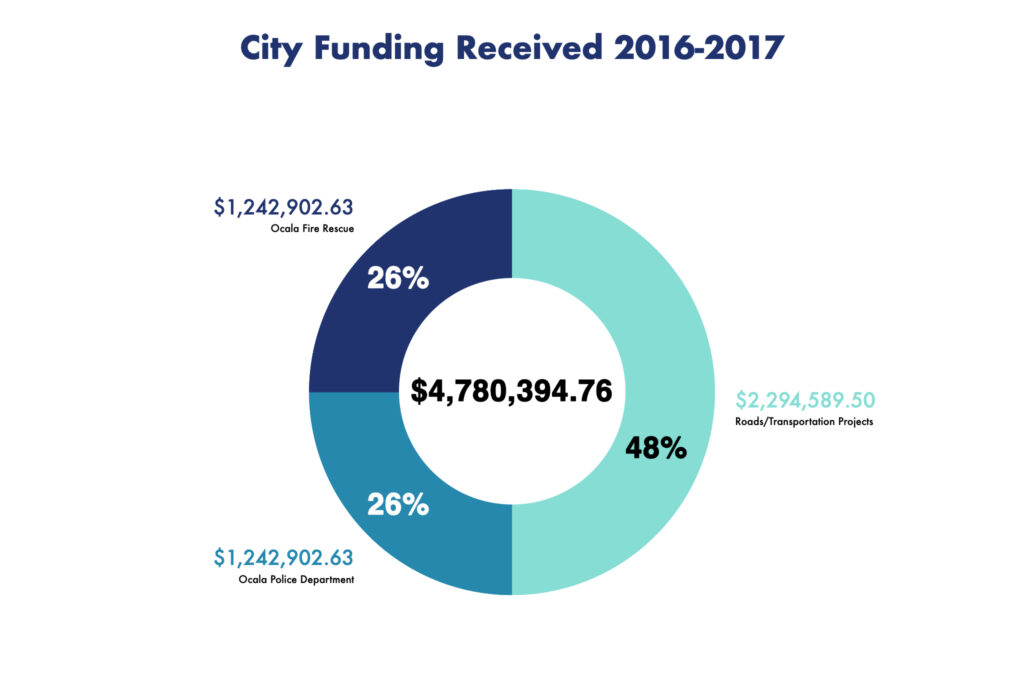

During the first four years of the tax, which was passed in 2016 and raised nearly $35.5 million for the city, police and fire received equal shares of 52% of the revenue, while roads and transportation projects got 48%.

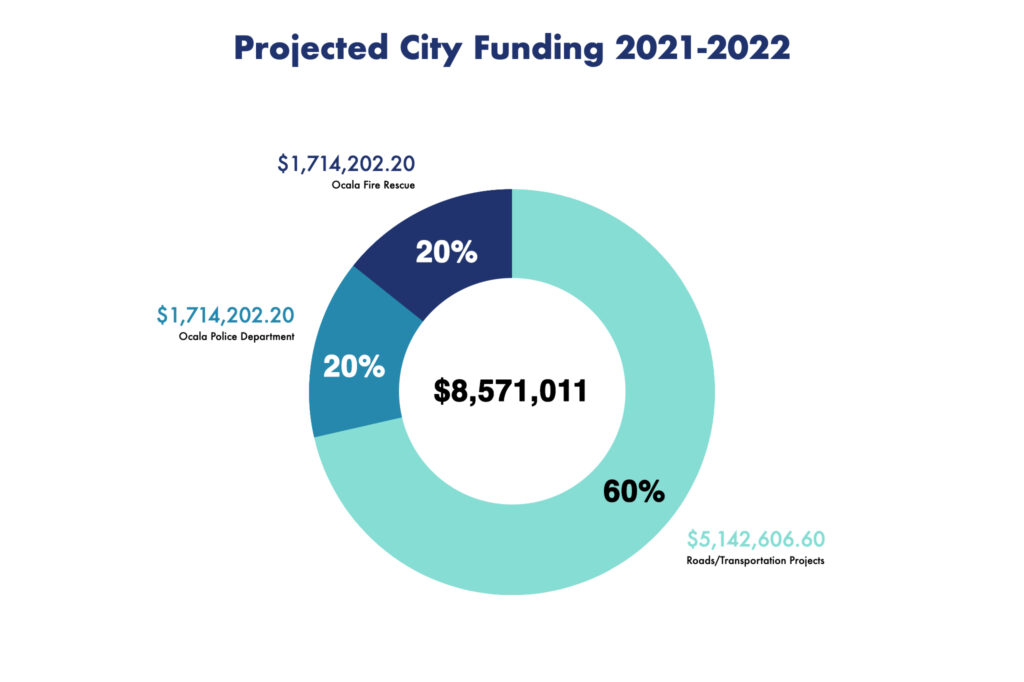

Voters approved a four-year extension of the tax in 2020. The Ocala City Council gave

city staff direction to shift spending to 60% for roads and transportation, and 40% divided equally between police and fire.

The tax adds a penny to the state’s 6% sales tax, which can only be spent on capital expenditures. The money cannot go toward staffing, payroll or recurring costs.

Meanwhile, public safety officials with the city have said the council has not turned down requests for more police or fire employees in the recent past.

Since 2017, Ocala Fire Rescue has hired 29 firefighters/EMTs, 12 firefighters/paramedics, one fiscal coordinator and two administration specialists.

“We do not have any job positions that were denied funding for at this time,” according to an email from Beth Antis of Ocala Fire Rescue’s Logistics & Information Management.

In fiscal year 2019, Ocala Police Department requested, and were granted 12 school resource officers in the wake of the Marjory Stoneman Douglas High School Public Safety Act, said Jeff Walczak, OPD spokesman.

Walczak said the department is approved for 194 sworn positions and 121 non-sworn positions, and they currently have 15 openings for eight non-sworn and seven sworn positions. OPD Chief Mike Balken has also previously said the council has not denied staffing requests in the past.

New Police and Fire Buildings

Among the capital improvements paid for with the sales tax money is $5.2 million used to build one new standalone fire station and one first responder campus, which includes a joint fire and police station. The standalone station, Fire Station No. 7, is located at 885 SE 31st St. The first responder campus is located on Northeast 8th Ave. and houses Fire Station No. 3 and OPD’s East District Office.

Additionally, the city used another $5 million of the penny sales tax to build the MLK firs t responder campus at 505 NW Martin Luther King Jr. Ave. That campus includes Fire Station No. 1, OPD’s West District Office and a community center building.

OPD will also use $1 million to expand its communications center, which houses 911 operations and takes emergency calls for police and fire.

New Vehicles

The OPD used $1.3 million to replace 43 vehicles, purchasing 38 Ford Interceptor sedans/SUVs in 2018 and 5 in 2019.

Public Safety Communications Equipment

OPD also purchased 242 new encrypted radios, shoulder microphones, batteries, and chargers for $1.2 million. Another $1 million went to buy 221 additional encrypted radios and base stations. Further, the city spent $64,461 to purchase multiple in-car video cameras and $57,261 on cameras for city parks.

An unmanned aerial system worth $40,700 was purchased in 2018, as was a video recording system for police interview rooms, costing $46,895. Finally, CrimeView software costing $130,000 was purchased in 2019. The software is used to analyze, and map reported crimes, as well as provide a detailed analysis of crime patterns.

Road/Transporation Projects

Road/Transporation Projects

The city spent $9.6 million on specific road improvement projects. Of the 19 projects, only one is still in progress. In addition to specific projects, the city also used penny sales tax funds on city-wide micro-surfacing of roads. The treatment helps refresh roads with minor wear and tear and can delay full resurfacing.

Looking Ahead

Ocala is projected to receive more than $8.5 million in penny sales tax funds in 2022.

Specific projects have not been identified. Under the new breakdown, road projects would receive approximately $5.1 million, and public safety would receive $3.4 million for capital spending.

A breakdown of how Marion County chose to spend its portion of the penny sales tax will appear in the Sept. 3 edition of the Ocala Gazette.