Mass resignations at Marion County municipalities

Editor’s Note: This report will be followed up with more information about what comes next.

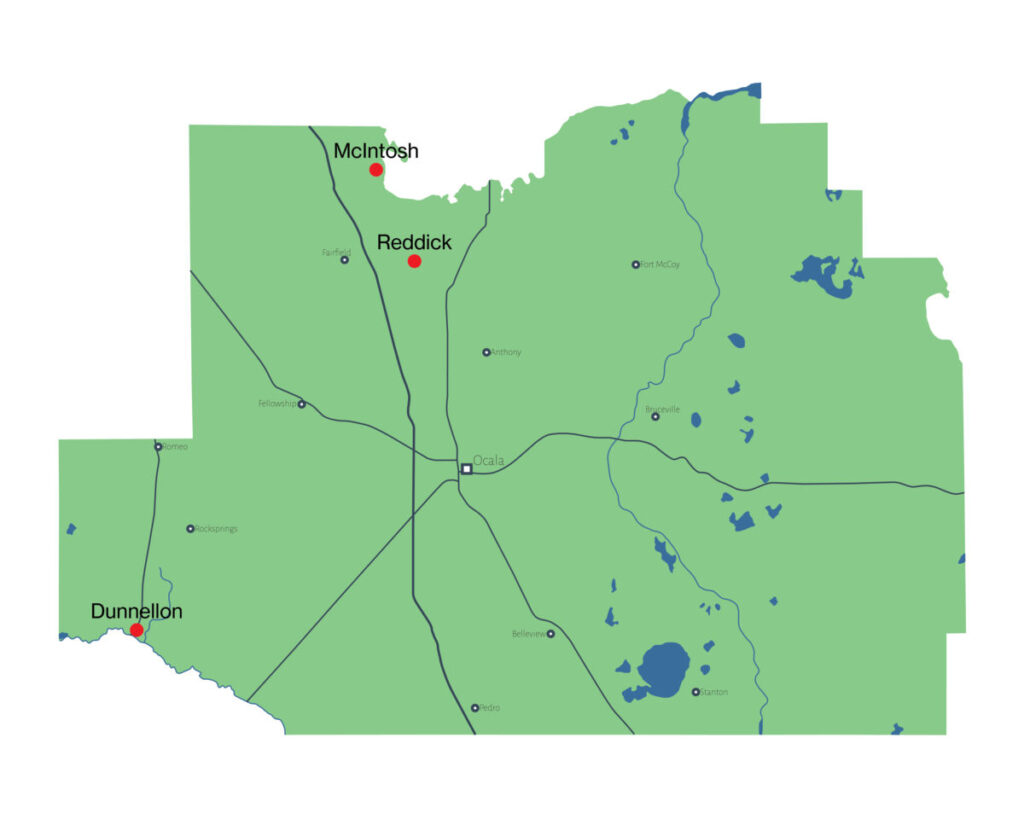

The new year has started with a lot of empty seats on city councils in the cities of Reddick, McIntosh and Dunnellon as more intensive financial reporting requirements took effect.

In 2023, after repeated attempts since 2015, the Florida Legislature passed SB774, requiring mayors and elected members of the governing body of a municipality to file more detailed financial disclosures.

Many communities across the state experienced mass resignations of elected officials before the start of 2024.

Here are the resignations so far in Marion County:

- The entire town council and mayor of the city of Reddick.

- Four out of five town council members for McIntosh.

- Two city council members for Dunnellon.

According to officials at the city of Belleview and the city of Ocala, as of Jan. 2, those cities had no resignations.

Marion County Supervisor of Elections Wesley Wilcox told the “Gazette” he is working to set a special election to fill the vacated seats, likely in early April after the presidential primaries in March.

The website for Reddick indicates that an informational meeting will be held on Jan. 4 at 7 p.m. at the Community Center, 4345 NW 152nd St.

In letters announcing their resignations, some of the officials pointed to SB774 as the reason for their action, while others remained silent.

Scott Mullikin, McIntosh’s prior city council president, wrote in his letter, “After researching the requirements for all elected officials, (paid or unpaid), to file the new Form 6 as voted into law recently by the State Legislature, I cannot in good faith disclose my financial information, (assets, liabilities and my financial institutions), to the general public, who has no reason to see my information. My own stepson has no idea what my liabilities and assets are. Why would I want to put that information out there for total strangers? I sincerely feel that this puts a target on my back for possible identity theft, scammers, thieves and other deceitful and dishonest people. I feel that I have been forced to choose to maintain my personal financial privacy.”

In her letter resigning from the McIntosh council, Melinda Jones wrote that it wasn’t only the disclosure, but the “intent of this form.”

“I cannot in good conscience expose that information for a non-paid position on our Town Council,’’ she wrote. “I believe that the Form 6 requirements are an intrusion into financial privacy, and something that was not required when I qualified to run for Council 3 years ago. It is my belief that all currently serving elected officials should have to continue to fill out the Form 1 through the end of their existing terms, and then be able to make their decision to complete Form 6 when, or if, they choose to run. I have truly enjoyed being on Council and have learned so much during the little over 3 years I have served. I am sad because I feel like I am disappointing those residents that have supported me during my time on Council.”

The differences between the historical financial disclosure requirements for elected municipal officials and what started on Jan. 1, 2024 is found by comparing Form 1 and Form 6.

Previously, city officials were required to only fill out a Form 1 and deliver it to their county’s supervisor of elections every year. Other elected officials, such as county commissioners, were required to fill out Form 6, which requires more information, and file it with the state.

According to the League of Cities, which opposed the measure, this is the difference in disclosure requirements:

Disclosure of Net Worth

Filers provide a sum of all assets, regardless of whether they are reported, and subtract all liabilities, regardless of whether they are reported.

| Form 1 | Form 6 |

| A review of your finances over the course of the year | A snapshot of your finances on 12/31 or a more recent day of filer’s choosing. |

| There is no net worth disclosure, but filers did calculate it for the comparative threshold. | Filers will disclose their net worth on 12/31 or a more recent day. |

Disclosure of Assets

Filers must disclose assets, including household goods and personal effects, anything valued over $1,000 that can be sold.

| Form 1 | Form 6 |

| Intangible personal property & certain real property in Florida | Intangible, Tangible & Real Property |

| Intangible assets over $10,00 individually | · Assets over $1,000 individually

· Household goods and personal effects collectively |

| Type of intangible, business name | Description of asset, value |

Disclosure of Liabilities

Filers must disclose liabilities over $1,000, with limited exclusions.

| Form 1 | Form 6 |

| Liabilities over $10,000 | Liabilities over $1,000 |

| Owed at any point in the year | Owed on the date chosen |

| Creditor name/address | Creditor name/address, amount |

| Exclusions for:

· Credit cards · Indebtedness on a life insurance policy · Taxes owed not reduced to a judgment · Contingent liabilities |

Same as form 1 |

|

|

Disclosure of Primary Sources of Income

Primary sources of income constitute gross income on federal tax returns and must include public salary. Instead of completing this form, filer may attach federal income tax return all and schedules and attachments instead.

| Form 1 | Form 6 |

| Income over $2,500 | Income over $1,000 |

| Do not disclose public salary | Disclose public salary |

| Source name/address, description of business | Source name/address and amount |

Disclosure of Secondary Sources of Income

Secondary sources of income are major clients/customers of businesses of which you own more than 5%. Major clients/customers include those who supply more than 10% of filer’s business’s gross income that year.

| Form 1 | Form 6 |

| Disclose clients/customers if:

· Own > 55 of the business; · Income from business >$5,000 · Client/customer contributed >10% of the business’s gross income |

Disclose clients/customers if:

· Own >5% of the business; · Income from business >$1,000 · Client/customer contributed >10% of the business’s gross income |

| Business name, client name/address, client business description | Same as Form 1 |

Note: There is no difference between Forms 1 and 6 when it comes to disclosing interests in specified business. Both require filer to disclose the name, address, business activity, position held, whether they own >5% and the nature of their ownership interest.