Marion schools’ budget a record $746.5 million

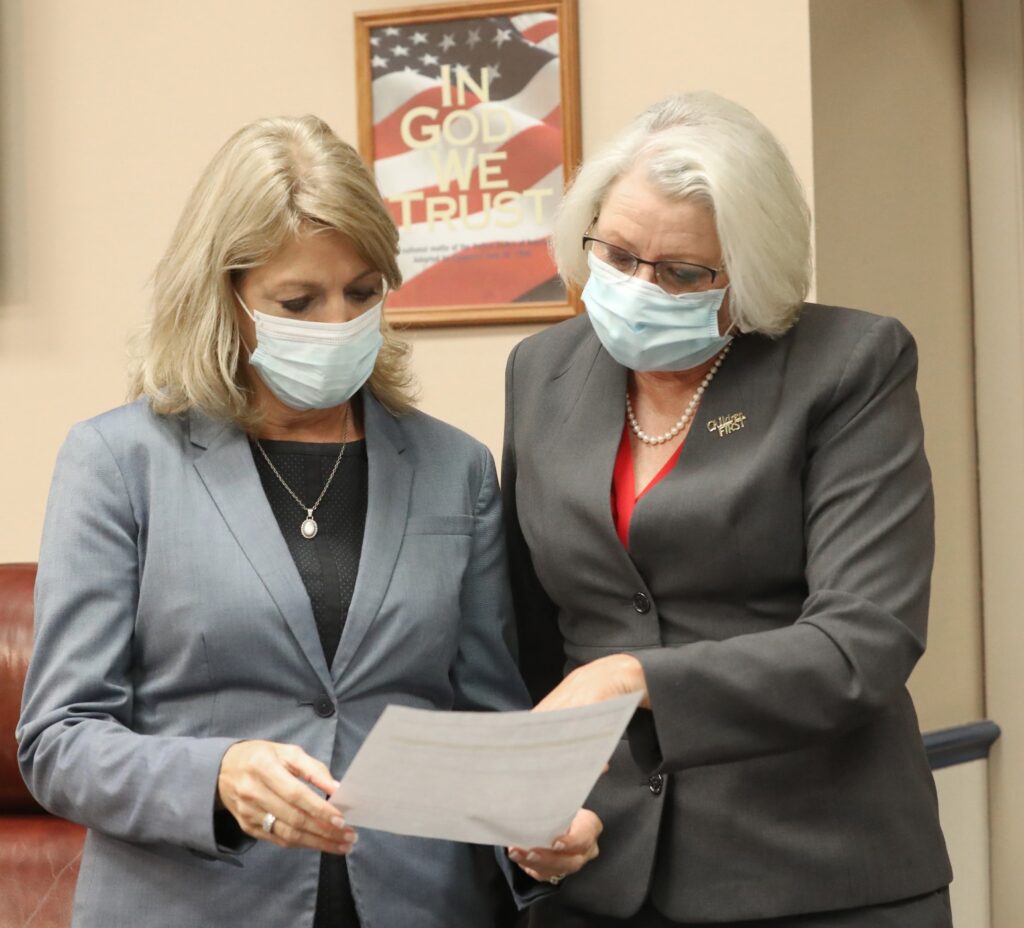

Dr. Diane Gullett, the Superintendent of Marion County Public Schools, left, talks with Nancy Thrower, the board chair, right, during a meeting at the Marion County Public School Board in Ocala, Fla. on Tuesday, Sept. 7, 2021. [Bruce Ackerman/Ocala Gazette]

Diane Gullett, superintendent of Marion County Public Schools, left, talks with Nancy Thrower, the school board chairwoman, right, before the board approved the school’s $746.5 million budget on Tuesday. [Bruce Ackerman/Ocala Gazette]

The board voted to adopt the budget unanimously with no discussion during a special meeting. The final budget eclipsed last year’s by more than $94.7 million.

Much of the increase came from more than $58 million from federal aid in response to the COVID-19 pandemic. The funds came from the Coronavirus Response and Relief Supplemental Appropriations Act which authorized $81.88 billion in support for education. The money can be used to prevent, prepare for and responding to COVID-19.

The school system also increased the budget by an additional $31.2 million to fully implement the school’s self-insurance plan, which began during the second half of the previous school year. The total amount budgeted is more than $65.2 million.

The lion’s share of the budget, $404.1 million, goes to salaries and benefits for about 7,000 employees. That’s an increase of more than $38 million from the previous year, according to budget documents.

Another $58.1 million will go for equipment, construction, remodeling and renovation of district facilities.

Services including leases, occupational, physical and speech therapy services, travel, repairs and maintenance and distributions to charter and private schools will take another $62.3 million.

The school also expects to collect more than $29.1 million thanks to a special 1 mill tax referendum first approved by Marion County voters in 2014.

The tax revenue is projected to increase by more than $3 million in the next year thanks to increased property values.

Voters voted to renew the referendum in 2018. The current four-year period runs through 2023, but voters will again decide if they want to keep the tax in 2022.

The money raised by the tax is used to help pay for reading, physical education, art, music, library/media and vocational programs. It can also go to help meet class size requirements and to retain state-certified teachers and paraprofessionals.

The 1 mill referendum is part of the total 6.9030 millage rate. The millage rate is a decrease of 0.115 mills from the prior year.

Each mill equals $1 for every $1,000 in taxable property value. The owner of a home with a taxable value of $100,000 would have to pay $690.30 in school taxes.

Due to higher property values, the tax is projected to reap more than $163.1 million. That is about $19 million more than last year.